Introduction

The pandemic has been a tough time for everyone and it has taken a toll on the economy as well. Many people have lost their jobs and are struggling to make ends meet. However, there are still opportunities out there for those who are willing to take the risk. Here are some tips on how to invest in pandemic:

1. Look for growth opportunities: There are still many companies that are doing well despite the pandemic. Look for companies that are growing and have a solid future outlook.

2. Be cautious: Don’t invest all your money in one stock or company. diversify your portfolio so that you’re not putting all your eggs in one basket.

3. Have a plan: Don’t just randomly buy stocks without doing your research first. Figure out what your goals are and what you’re trying to achieve with your investments.

4. Stay disciplined: Even if things are going well, don’t get too complacent. Stay disciplined with your investing strategy and don’t let emotions get in the way of making good decisions.”

What is pandemic?

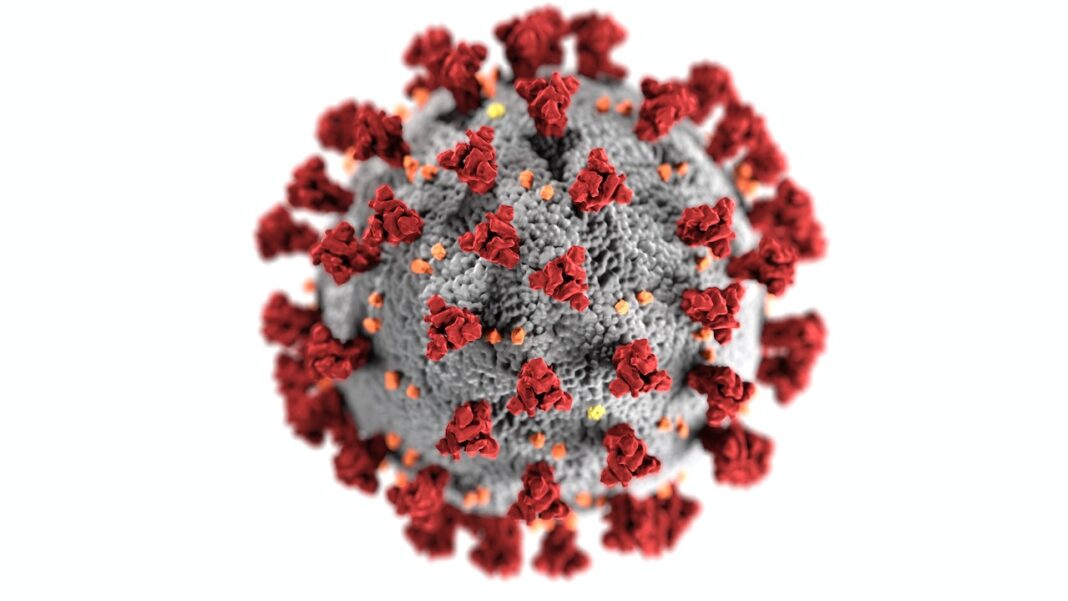

A pandemic is an outbreak of a disease that occurs over a wide geographical area and affects a large number of people. Pandemics can be caused by a new strain of a virus, or by the re-emergence of an existing virus. The World Health Organization (WHO) defines a pandemic as “an epidemic occurring worldwide, or over a very wide area, crossing international boundaries and usually affecting a large number of people”.

The symptoms of a pandemic can vary depending on the disease, but may include fever, coughing, difficulty breathing and pneumonia. In some cases, a pandemic can be fatal. Pandemics can have a significant impact on businesses, with many companies forced to close their doors temporarily while others see an increase in demand for their products or services.

Investing during a pandemic can be difficult, as there is often uncertainty about how long the outbreak will last and what the economic impact will be. However, there are some sectors that tend to do well during these times, such as healthcare and technology. It is important to research any potential investments carefully before making any decisions.

How to invest in pandemic?

When it comes to investing during a pandemic, there are a few things you should keep in mind. First and foremost, you need to be aware of the risks involved. There is always the potential for loss when you invest, and this is magnified during times of economic uncertainty.

That being said, there are also opportunities to be had during a pandemic. If you choose your investments carefully, you can position yourself to profit from the situation.

Here are a few tips on how to invest during a pandemic:

1. Do your research: It’s important to really understand what you’re investing in before putting any money down. This is especially true during a pandemic, when there is so much uncertainty in the markets. Make sure you know what you’re buying, and that you’re comfortable with the risks involved.

2. Diversify your portfolio: One of the best ways to mitigate risk is to diversify your investment portfolio. This means investing in a variety of assets, including stocks, bonds, and real estate. By spreading your money across different asset classes, you can minimize your losses if one sector takes a hit.

3. Stay disciplined: When it comes to investing, it’s important to have a long-term perspective. This can be difficult during a pandemic, when there is so much short-term volatility in the markets. However, if you stay disciplined and

Track net worth

When it comes to investing during a pandemic, one of the key things you need to do is track your net worth. This will help you understand how much your portfolio has grown or declined in value, and will also give you a good idea of where you stand financially. There are a few different ways to track your net worth, but one of the simplest is to use a personal finance app like Mint or Personal Capital.

Both Mint and Personal Capital offer free versions that allow you to connect all of your financial accounts in one place and track your net worth over time. If you’re not sure where to start, we recommend checking out our guide to the best personal finance apps. Once you have a good handle on your net worth, you can start making decisions about how to invest during a pandemic.

Short term investment

When it comes to investing, there are different strategies that can be employed – each with its own set of pros and cons. Some people like to take a long-term approach, investing in assets that they expect will appreciate over time. Others prefer a more short-term strategy, looking to buy low and sell high in a relatively short period of time.

There are also those who advocate for a more passive approach, holding onto investments for the long haul and letting them ride through the ups and downs of the market. And then there are those who take an active approach, buying and selling frequently in an attempt to beat the market.

No matter what your investment strategy is, there are certain assets that can be helpful during a pandemic. Here are a few things to keep in mind if you’re looking to invest in pandemic:

1. Gold and other precious metals have historically been seen as safe haven assets during times of economic turmoil. If you’re looking for a short-term investment, gold could be a good option.

2. Another asset class that can perform well during periods of economic uncertainty is government bonds. These tend to be less volatile than stocks and offer stability during turbulent times.

3. Cash is always king during a crisis – so if you have cash on hand, you may want to consider keeping it in a savings account or money market fund where it can earn interest while preserving its purchasing power.

4. While stocks tend

long term investment

Investing during a pandemic can be a difficult decision. Many people are wondering if now is the time to invest or if they should wait until the pandemic is over. There are many factors to consider when making this decision.

One factor to consider is your investment goals. Are you looking for short-term gains or are you investing for the long term? If you are investing for the long term, then you may be more willing to weather the storm of a pandemic and ride out any market volatility.

Another factor to consider is your risk tolerance. How much risk are you willing to take on? If you are comfortable with a higher level of risk, then you may be more likely to invest during a pandemic. However, if you are risk-averse, then you may want to wait until the situation stabilizes before investing.

No matter what your decision is, it’s important to do your research and make sure that you are comfortable with the risks involved. Investing during a pandemic can be a great opportunity to get in on some good deals, but it’s not for everyone. Be sure to weigh all of your options before making any decisions.

Not binary

In recent years, there has been a growing awareness of the non-binary nature of gender. This is not just a trend; it’s a reality. More and more people are identify as non-binary, and this is reflected in how they live their lives.

This is also true when it comes to investing. Non-binary people have different financial needs and goals than binary people. They may be more risk-averse or have different priorities when it comes to saving and spending.

Non-binary people are often overlooked by the financial industry. But there are a growing number of financial advisors and products that cater to non-binary clients. If you’re non-binary and looking for advice on how to invest your money, here are a few places to start:

1. Look for an advisor who understands your unique needs.

2. Research investment products that are designed for non-binary investors.

3. Consider using a robo-advisor, which can provide personalized advice without bias.

Is it safe to invest During pandemic?

As we all know, the Covid-19 pandemic has been a tough time for everyone. Many people have lost their jobs and are struggling to make ends meet. However, some people are still doing well financially and are looking for ways to invest their money. The question is, is it safe to invest during a pandemic?

The answer is that it depends. If you’re comfortable with the risks, then investing during a pandemic can be a good idea. The stock market can be volatile during times of crisis, but it can also rebound quickly. So if you’re patient and have a long-term investment plan, you could see some good returns on your investment.

Of course, there are also risks associated with investing during a pandemic. For example, if the crisis continues for a long time or worsens, then your investments could lose value. And if you need to sell your investments quickly, you may not get as much money back as you put in.

So it’s important to weigh the risks and benefits before deciding whether or not to invest during a pandemic. If you’re not comfortable with the risks, then it’s probably best to wait until the situation stabilizes before making any big decisions.